India got its Independence this month, when do you plan to get your Financial Independence?

When you are declaring your “FINANCIAL INDEPENDENCE DAY” ??

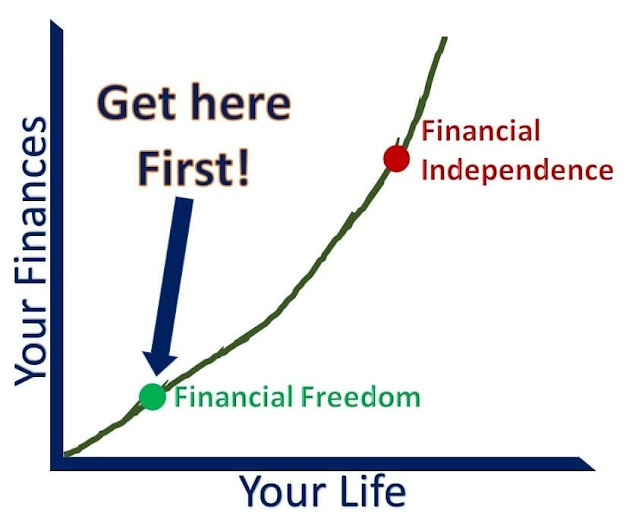

Why do we say it's Independence Day and not Freedom Day?

Financial Freedom means having no debts or financial obligations and also the ABILITY to purchase assets without having to rely on debt. Financial Independence means you have so much money that your money (wealth) supports the lifestyle you want

Know more about this and get more insights in our article in our blog SRIKAVI MONEY You can read the article here

Srikanth Matrubai

Author of the Amazon Best Seller DON'T RETIRE RICH

Do read the book and give your valuable feedback and request you to post positive comments on the Amazon.

https://amzn.to/3cHUM6M/

You can purchase the book on amazon and flipkart

Please subscribe to my TELEGRAM channel

https://t.me/MutualFundWORLD/